Addressing Long-Term Money and Mental Health Issues

Addressing Long-Term Money and Mental Health Issues

Addressing Long-Term Money and Mental Health Issues – New findings from our research reveal a concerning reality: a staggering 800,000 individuals in the UK find themselves entrenched in a persistent cycle of money and mental health issues.

While this news is disquieting, it’s crucial to understand that such long-term challenges are not inevitable. By offering timely and effective support, we have the power to interrupt this detrimental cycle, preventing difficulties from becoming deeply rooted.

This is the summary of the this findings:

- Summarily, recent research findings reveal a concerning reality: a staggering 800,000 individuals in the UK find themselves ensnared in a persistent cycle of money and mental health issues. Moreover, an additional 3.4 million people are teetering on the brink of falling into this distressing pattern. While these figures are indeed troubling, it’s imperative to recognize that such protracted struggles with money and mental health need not be an unavoidable fate. There is hope, and the cycle can be disrupted.

- In addressing these interconnected challenges, it’s clear that a coordinated, collaborative approach is essential. We urge the government, regulators, consumer organizations, and health and advice services to unite and take immediate, concerted action. These issues are multifaceted and demand a comprehensive response.

- Our primary call to action is directed towards the government: we advocate for the establishment of a cross-government taskforce dedicated to both preventing and dismantling the entrenched cycle of money and mental health problems. This taskforce would serve as a vital mechanism for coordinating efforts across various sectors and driving meaningful change.

- Our report serves as a critical resource for policymakers, service commissioners, regulators, and essential service providers. Each of these stakeholders has a crucial role to play in breaking this pervasive cycle. By engaging with our findings and recommendations, they can contribute to the development and implementation of effective strategies to address these pressing issues head-on.

Unfortunately, not everyone currently has access to the support they need. With an additional 3.4 million individuals in the UK at risk of falling into this same enduring cycle, the imperative to intervene has never been more urgent. It is imperative for the government, regulators, cross-sector organizations, and service providers to take decisive action to ensure that support is accessible to all.

SEE ALSO: Health Benefits of Botanicals

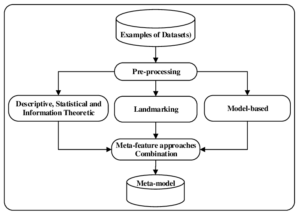

Many interventions across the country aim to prevent the escalation of mental or financial health issues. However, these efforts often operate in isolation, failing to address the interconnected nature of these challenges and hindering timely recovery. We advocate for a unified approach from government, regulators, and service providers to address these long-term issues comprehensively.

One individual shared their experience: “I didn’t realize how deeply intertwined my mental health and finances were. Years of shame and anxiety about money fueled a downward spiral in my mental well-being. I felt hopeless and saw no way out of my financial troubles.”

We call upon the government to establish a cross-government taskforce dedicated to preventing and breaking the cycle of money and mental health problems. Additionally, we urge for improved data-sharing infrastructure to facilitate more seamless collaboration between services and for services to go beyond mere signposting and actively partner with organizations that can provide direct support to those in need.

It’s crucial to allocate adequate funding and resources to ensure that services can effectively refer individuals to one another and provide comprehensive support. Current waiting times for mental health and debt advice services are unacceptable, leaving individuals in limbo for weeks before receiving assistance.

The urgency of addressing these issues cannot be overstated. As living costs continue to rise, more individuals find themselves struggling to access essential support for their mental and financial well-being. Our report serves as a vital resource for policymakers, service commissioners, regulators, and essential service providers, outlining the necessary steps to protect those at risk and help those already caught in the cycle to break free.

Money and mental health are deeply interconnected for several reasons:

- Stress and Anxiety: Financial difficulties often lead to stress and anxiety, which can exacerbate existing mental health conditions or trigger new ones. The constant worry about bills, debt, and financial stability can significantly impact one’s mental well-being.

- Self-esteem and Identity: For many people, their financial situation is closely tied to their sense of self-worth and identity. Struggling financially can lead to feelings of failure, inadequacy, and shame, which can negatively impact mental health.

- Access to Resources: Financial resources play a crucial role in accessing mental health care and support. Individuals facing financial challenges may find it difficult to afford therapy, medication, or other forms of treatment, further exacerbating their mental health issues.

- Interference with Daily Functioning: Financial problems can interfere with daily functioning, making it challenging to maintain relationships, work, or engage in leisure activities. This disruption can contribute to feelings of hopelessness and depression.

- Cyclical Nature: The relationship between money and mental health can create a vicious cycle. Mental health issues may lead to poor financial decisions or difficulties maintaining employment, which in turn worsens financial problems and mental health.

- Social Stigma: There is often a stigma associated with both mental health issues and financial struggles. This stigma can prevent individuals from seeking help or support, further perpetuating the cycle of isolation and distress.

Overall, the connection between money and mental health is complex and multifaceted, highlighting the importance of addressing both issues holistically to support individuals in achieving overall well-being.

Source: moneyandmentalhealth.org

2 thoughts on “Addressing Long-Term Money and Mental Health Issues”

Comments are closed.